Corporate Transparency Act Delayed After Supreme Court Lifts Injunction

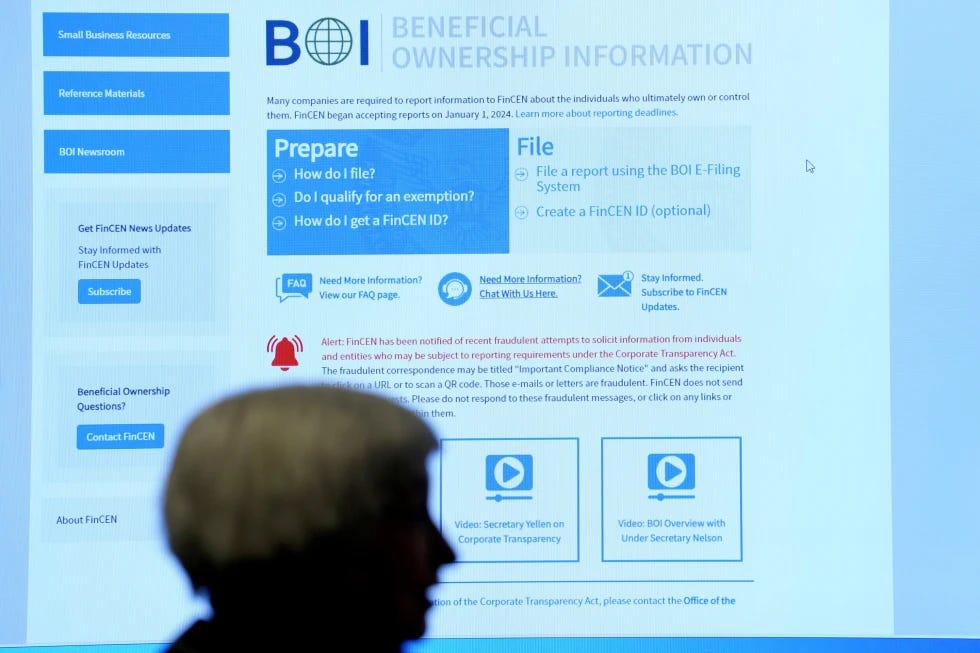

NEW YORK (AP) — Small businesses are not yet required to register with the Financial Crimes Enforcement Network (FinCEN), despite the Supreme Court lifting an injunction related to the Corporate Transparency Act (CTA).

The CTA, passed in 2021 as part of efforts to combat money laundering and shell corporations, mandates that owners and part-owners of an estimated 32.6 million small businesses submit personal details to FinCEN, including photo identification and home addresses.

While the law aims to improve transparency and reduce illicit financial activities, critics, particularly small business advocates, argue that the reporting requirements impose unnecessary burdens.

The law’s implementation has been stuck in legal uncertainty for some time. On Thursday, the Supreme Court removed an injunction connected to a lawsuit over the act. However, FinCEN clarified on Friday that due to another ongoing court case involving a separate injunction, registration remains voluntary for the time being.

“In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and will not face penalties if they fail to comply while the order is in effect,” the agency explained on its website.

FinCEN added that businesses are still welcome to voluntarily submit beneficial ownership reports.

Even if the registration requirement eventually takes effect, it remains uncertain whether the Trump administration will actively enforce it, given the opposition from Republican-led states, lawmakers, and various conservative and business interest groups.